Carbon Markets, Illustrated

A brief guide to one of the climate solutions we need in order to achieve a low-carbon future faster

But even though carbon markets could create much-needed incentives for faster climate action, they are often misunderstood.

How can carbon markets help solve the climate crisis?

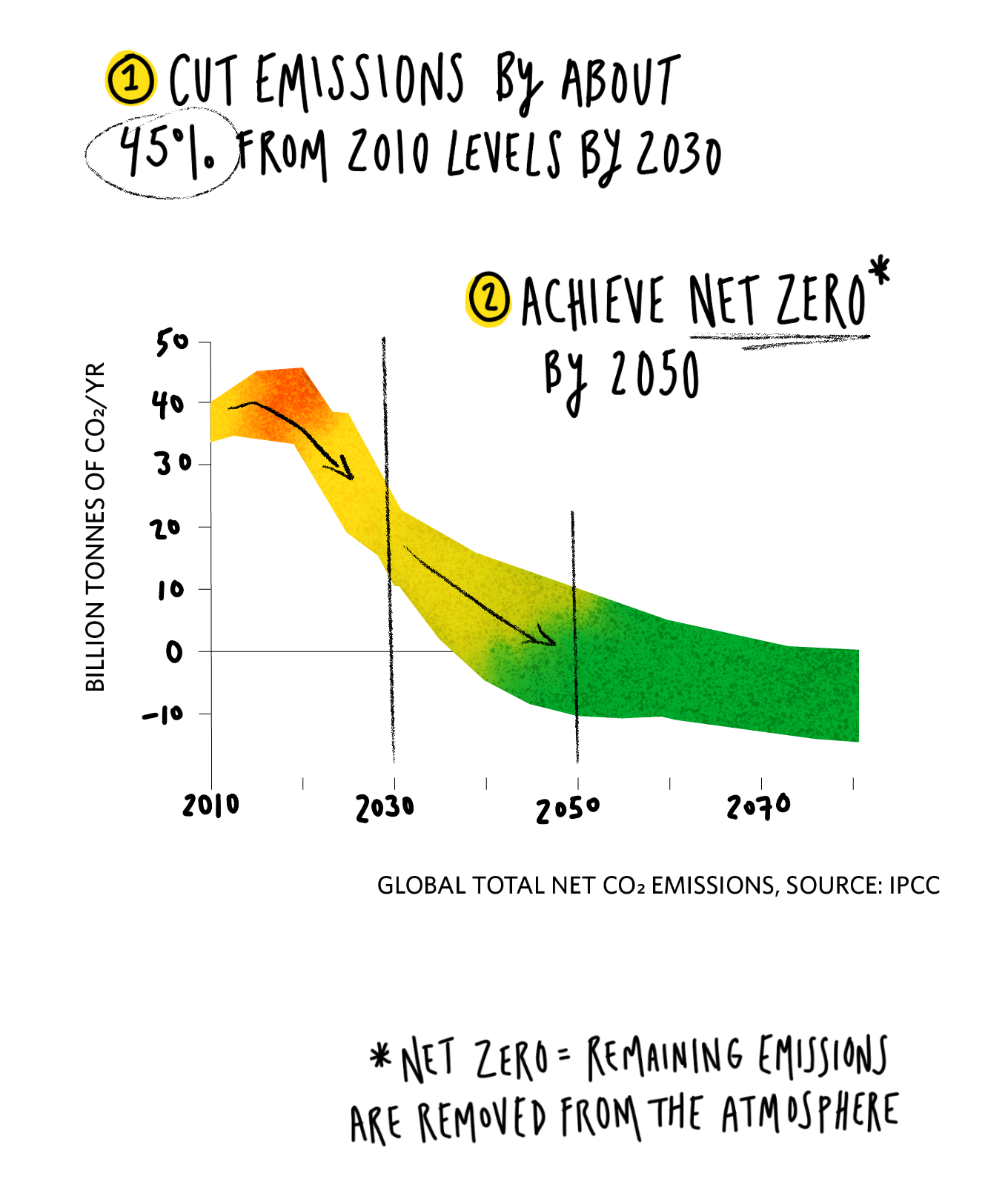

The Intergovernmental Panel on Climate Change (IPCC) has identified two major climate mitigation imperatives to keep global temperatures within a safer range:

Eliminating greenhouse gas (GHG) emissions will be easier for some governments and companies than others. Consider that technological advances have improved the efficiency of the cars we drive faster than the planes we fly, for example.

How do carbon markets reduce emissions?

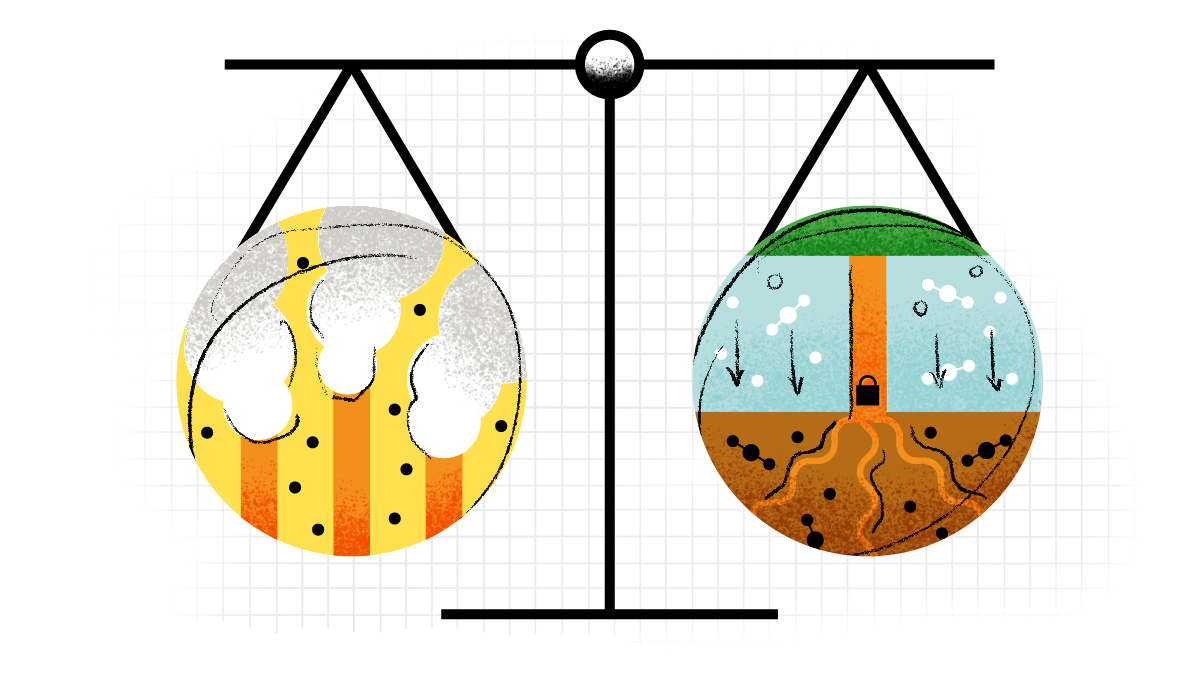

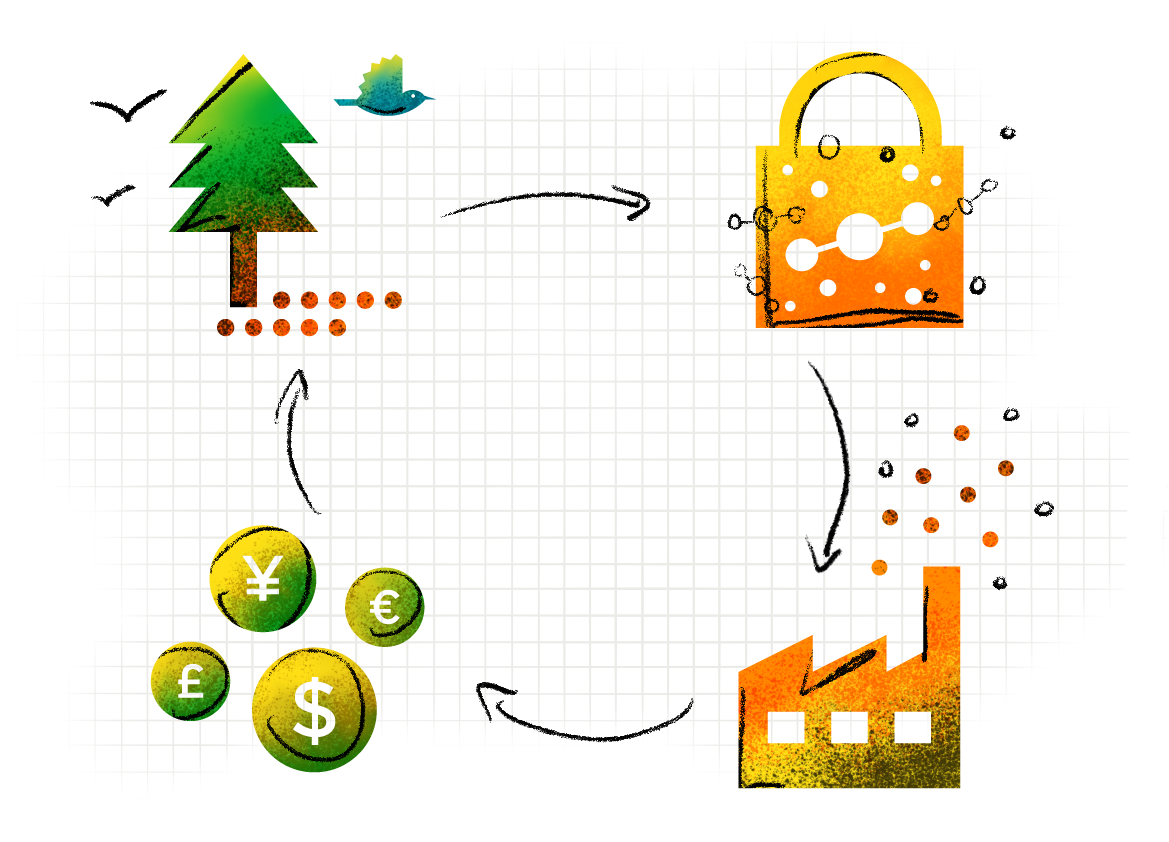

The practice of offsetting is simple enough in theory. It entails reducing or removing GHGs in one place to compensate for emissions elsewhere.

You’re probably familiar with the sources of emissions, but what about these solutions that reduce, remove and store them?

Through carbon markets, such projects can sell or trade carbon credits to emitters who wish to offset the negative effects of their emissions. Carbon markets can either be built for voluntary participation (think: companies that have made their own net-zero commitments) or compliance with legal frameworks.

Do carbon credits give companies permission to pollute?

Before purchasing carbon credits, companies should first invest in the technological innovations, improved management practices, and asset turnover needed to reduce the greenhouse gas emissions from their business operations. Once companies have reduced their greenhouses gases as much as feasible, they can use carbon credits to offset their emissions that remain and thus make more rapid climate progress.

What is a Carbon Credit?

A carbon credit represents one ton of carbon dioxide or equivalent greenhouse gases that have been reduced, avoided, or removed by a mitigation activity. Carbon credits are issued to project developers after they have met stringent rules set out by governments or an independent certification body and after being verified by a third-party auditor.

What makes a carbon credit “high-quality”?

To be effective, only high-integrity credits should reach the market.

Carbon market standards are developed through an open process of public consultation, transparency, and independent third-party assessment. High-quality carbon markets must address:

- Additionality: A carbon credit is “additional” if it represents emission reductions that are above and beyond what would have been achieved under a “business as usual” scenario and would not have occurred in the absence of the carbon market project.

- Permanence: Emissions that are removed or reduced need to be permanently removed or reduced in order to have impact for the climate. Permanence means the carbon benefit should last for at least 100 years.

- Leakage: When a project stops carbon-emitting activities—such as deforestation—in one area, but the carbon-emitting activities simply shift to another area.

- Safeguards: There must be strong safeguards to protect biodiversity and to ensure that communities and Indigenous peoples are able to fully and freely participate in and benefit from the project.

But this is just a starting point. TNC’s Global Carbon Market Team oversees engagement and has developed a set of standards for high-quality carbon offset projects based around three principles: robust carbon accounting, maximizing returns and benefits for communities and nature, and the responsible use of offsetting.

Why have the standards for carbon markets changed?

Carbon markets—like any other new tool or technology—need to be given the space to continuously improve over time.

TNC has more than 20 years of experience pioneering best practices for Natural Climate Solutions and carbon projects around the world. We are committed to supporting high-quality carbon credits that fight climate change, conserve natural ecosystems, and provide equitable benefits to Indigenous, local, and urban communities.

Scaling up carbon markets faster—and getting them right—will be essential to reducing emissions in the near term, and funding the low-carbon future we need.

Still curious about carbon markets? Watch this short video.

Subscribe for More Insights

This article is the first in a two-part series on technology and innovation that ran in the March 2021 issue of the Global Insights newsletter. Subscribe here to get part two and other exclusive insights like these straight to your inbox.

Leave a Reply