Correspondence

Improving calculations of energy return on investment.

Charles A. S. Hall [1] & Graham Palmer [2]

[1] SUNY College of Environmental Science and Forestry, Syracuse, NY, USA.

[2] Department of Civil Engineering, Monash University, Clayton, Victoria, Australia.

Nature Energy (2025)

10 January 2025

Maintaining energy supply is a critical challenge as we strive to transition away from fossil fuels. Energy return on investment (EROI) is a tool widely used by energy analysts to help understand the efficiency with which we extract, deliver, and use energy. Initial research in this area focussed on the EROI of extracting energy from nature, using direct energy costs where available and deriving indirect energy costs from economic data to infer relatively comprehensive energy cost assessments.1,2 More recent studies have increasingly expanded the boundaries of the denominator by including additional energy required to refine and deliver energy to its final point of use.3,4 Such studies, sometimes called harmonization studies, attempt to ensure consistent comparisons across different energy sources,5,6 and conclude that the EROI of renewables surpasses that of fossil fuels. We find this conclusion surprising, as it is opposite to earlier studies. While we agree on the importance of accounting for all costs associated with energy technologies and applaud the efforts of such studies to “compare apples with apples,”6 we believe that there are at least five ways in which these assessments could be improved.

First, the most common approach to measuring EROI for renewable technologies is life cycle assessment (LCA). While this approach is usually regarded as accurate within its defined boundary, it is subject to two important types of truncation error.7 The first is sideways truncation, where many small but collectively significant processes—such as service activities—are excluded because they are individually minor and too numerous to measure. Established LCA cut-off rules often lead to their exclusion, yet they can account for about half of the total energy costs, as demonstrated by more comprehensive environmentally extended input–output analyses (EEIOA) or energy intensities of financial activity.7,8 This truncation could halve the EROI of technologies like solar photovoltaics. The second is downstream truncation, where system-level processes that lie beyond the electrical busbar or inverter—such as storage, firming, and transmission—are typically omitted. These system-level processes are critical for understanding energy transition but are difficult to capture within the scope of an LCA-based EROI study. To address these limitations, studies must expand their boundaries of analysis.

Second, it is essential that energy technologies are assessed using comparable methodologies. Some studies calculate national and global EROI estimates using national or multi-regional EEIOA,4 while most EROI assessments for wind and solar technologies rely on LCA. It is therefore essential to use the same methodology and the same boundaries when comparing any energy technologies.

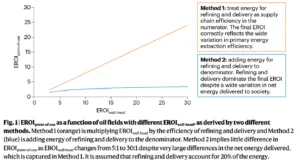

Third, it is critical to ensure that mathematical frameworks for EROI are the best fit for the questions being asked. The recent expansion of EROI analysis to account for the energy used at the ‘point-of-use,’ ‘point-of-application,’ or ‘useful stage’ has introduced a mathematical approach that incorporates the energy used for refining and delivery into the denominator, which may in turn allow these processes to dominate the overall assessment. For example, refinery self-use—energy consumed during the refining process—is typically derived from the input stream and reduces the amount of energy delivered only slightly. However, adding this to the EROI denominator reduces the derived EROI significantly, even when the crude comes from highly productive (high EROI) oil fields (Fig. 1). By contrast, deducting self-use from the numerator aligns with conventional industrial practices, where internal energy consumption is considered part of supply chain efficiency.

Fourth, EROI is a valuable tool, but its insights should be understood within the broader context of techno-economic feasibility and practical application. While recent studies in this area suggest that renewables may outperform fossil fuels in some energy services, such as providing high-temperature heat,4 powering processes such as metal smelting or ammonia synthesis with renewable energy may be far more costly and challenging in practice.9 Likewise, the motor of an electric long-haul truck may use its energy more efficiently, but it might spend much of that energy moving batteries. In all cases, a broad systems approach is required.

Finally, it is critical to use representative data, avoiding assessments based on selective filtering. This applies across both renewable and fossil fuel technologies and includes considerations such as the age of the data, geographic representativeness, and methodological consistency. For example, oil field analysis should include a sample of production fields that accurately represents the EROI of global oil production, rather than focusing on lower-EROI fields, as much of the world’s oil comes from relatively high-EROI fields.10 There are many compelling reasons to encourage the use of renewable energies, including reduced environmental impacts, greater efficiency in certain applications, and enhanced support for transitioning from fossil fuels. However, we believe that one cannot conclude that EROI is a decisive factor favouring renewables, at least until fuller assessments are undertaken that account for these points.

References

1. Hall, C. A. S. Energy Return on Investment: A Unifying Principle for Biology, Economics, and Sustainability (Springer Nature, 2017).

2. Cleveland, C. J., Costanza, R., Hall, C. A. S. & Kaufmann, R. Science 225, 890–897 (1984).

3. Brockway, P. E., Owen, A., Brand-Correa, L. I. & Hardt, L. Nat. Energy 4, 612–621 (2019).

4. Aramendia, E. et al. Nat. Energy 9, 803–816 (2024).

5. Murphy, D. J., Raugei, M., Carbajales-Dale, M. & Estrada, B. R. Sustainability 14, 7098 (2022).

6. Raugei, M. Nat. Energy 4, 86–88 (2019).

7. Palmer, G. & Floyd, J. Biophys. Econ. Resour. Qual. 2, 15 (2017).

8. Gamarra, A. R., Lechón, Y., Banacloche, S., Corona, B. & de Andrés, J. M. Sci. Total Environ. 867, 161502 (2023).

9. Humbert, M. S., Brooks, G. A., Duffy, A. R., Hargrave, C. & Rhamdhani, M. A. J. Sustain. Metall. 10, 1679–1701 (2024).

10. Brandt, A. R. et al. PLoS One 10, e0144141 (2015).

Improving Calculations of Energy Return on Investment

Charles A. S. Hall & Graham Palmer, Nature Energy, 10 January 2025

https://www.nature.com/articles/s41560-024-01696-3

https://rdcu.be/d5Q5A

https://canadiancor.com/171875-2/

Can I republish this article in my journal, with proper attribution?

Luis T. Gutierrez, PhD

Editor, Mother Pelican Journal of Solidarity and Sustainability

https://www.pelicanweb.org

[email protected]

Yes, the more people that read and understand, the better.